Updated: 2025-03-24

Prepare a T776 Statement of Real Estate Rentals to report income and claim expenses related to rental properties either in Canada or abroad. Many of the concepts used to complete this form also apply to other T1 income statements and expense claims. We suggest starting with this topic to familiarize yourself with these tasks.

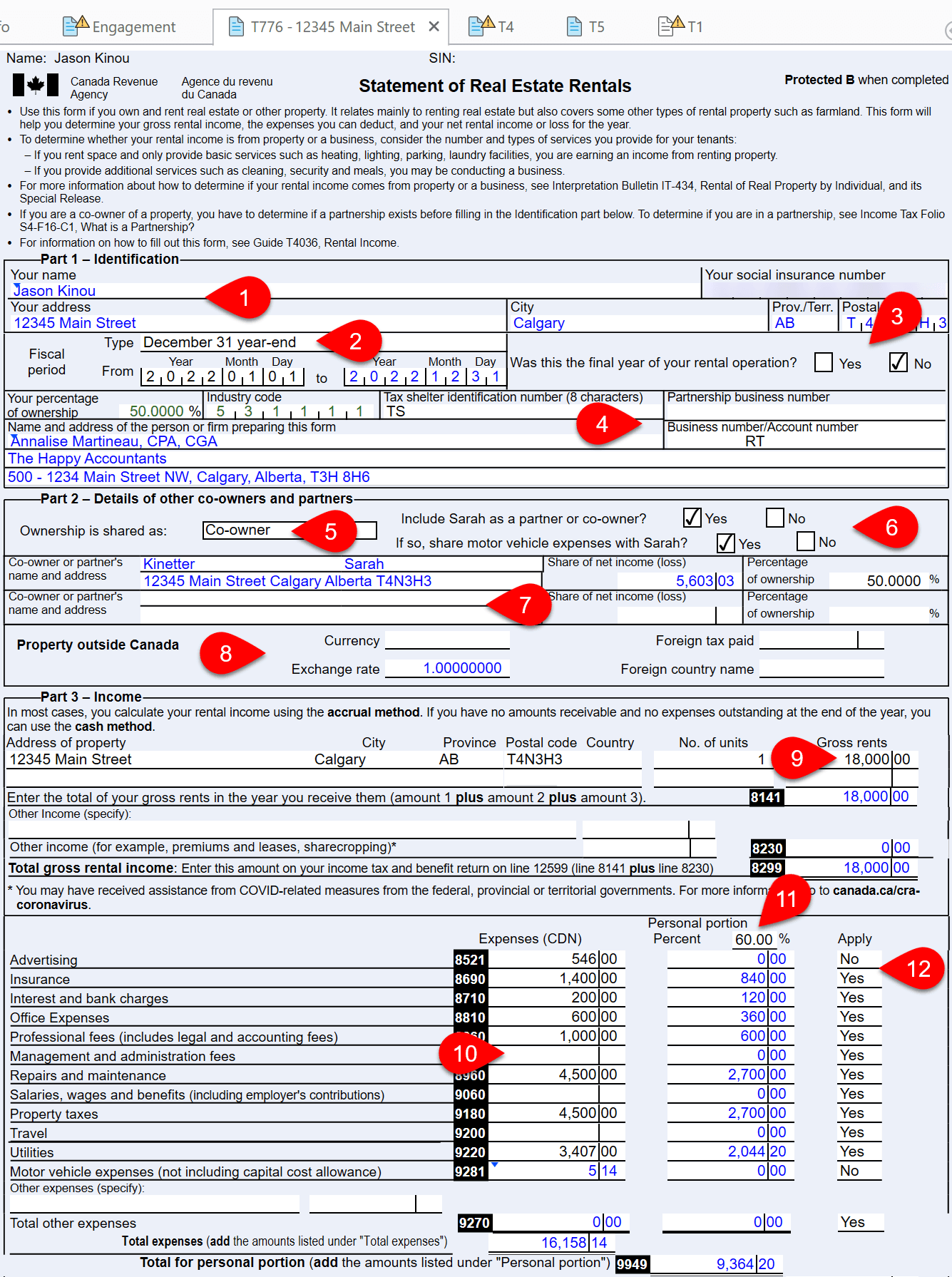

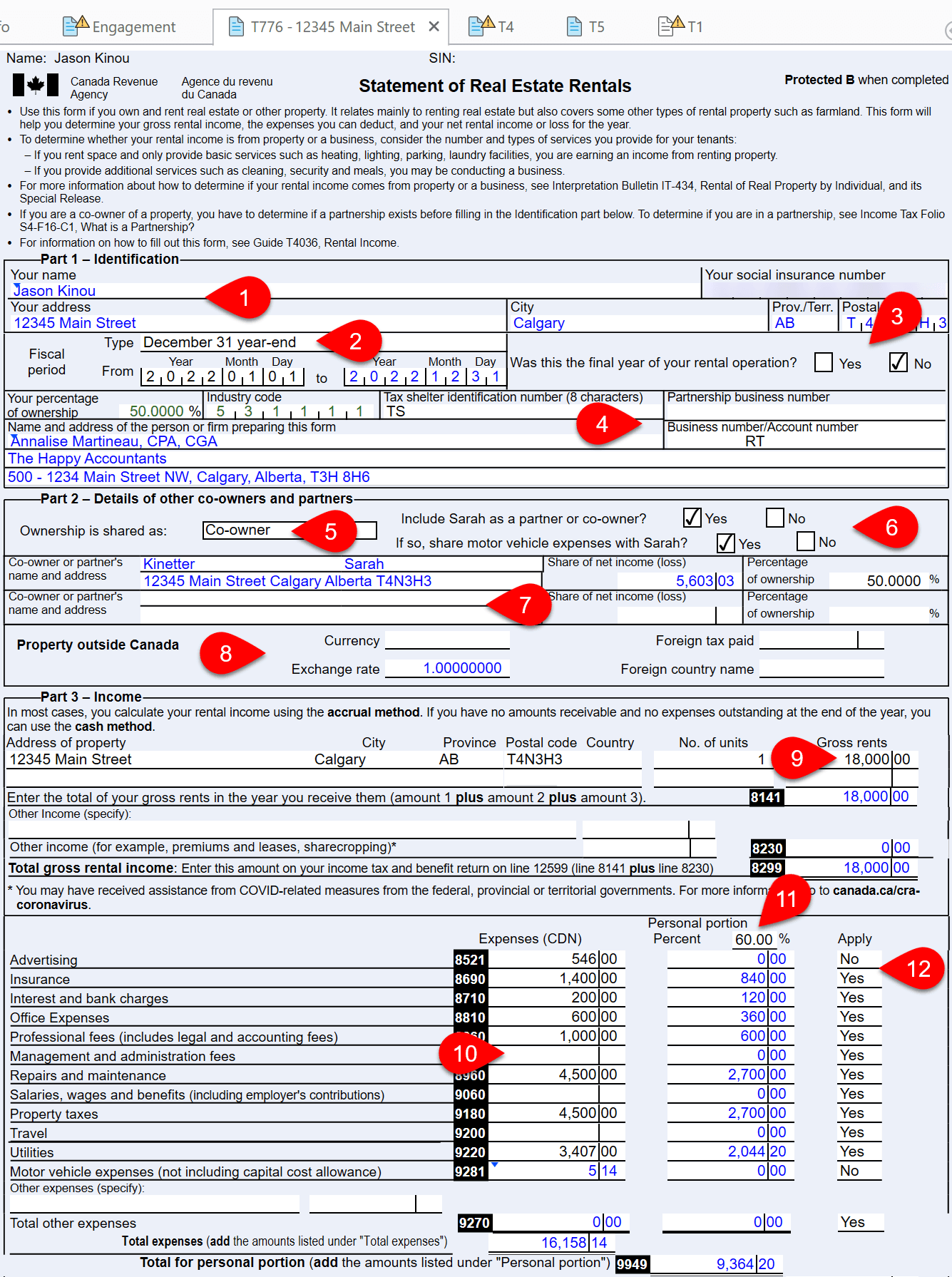

Completing the T776

- Most of the details about the taxpayer in the Identification flow from the Info worksheet.

- Begin by entering the fiscal period and then select the type. TaxCycle changes the start and end dates based on this selection.

- Select December 31 year end and the start date field remains editable while the end date becomes a calculated field.

- Select Closing rental operation and both fields become editable.

- Answer the question Was this the final year of the rental operation.

- If applicable, provide the tax shelter identification number, partnership business number or business/account number.

- If ownership of the rental property is shared, select the ownership share type—co-owner or partner. See Co-owner or Partner, below, for guidance on choosing the correct type for your client.

- If the spouse is a partner or co-owner, check the box to share the rental statement. This automatically adds the spouse’s information to the table. Assign an ownership percentage. To calculate the spouse’s share of motor vehicle expenses, based on the percentage of ownership, check the box to share motor vehicle expenses with the spouse.

- For co-owners or partners who are not spouses, complete one row for each person and assign an ownership percentage. (If you are also preparing the return for a partner who is not a spouse, you can use Smart Copy/Paste to copy the income statement to that return.)

- If the rental property is outside Canada, complete the Property outside Canada section. For details, see Foreign Rental Properties, below.

- In the Income section, complete one line for each property, entering the address, the number of units and the gross rents. Alternately, you can create separate T776 statements for each property. If the rental property is outside Canada, see Foreign Rental Properties, below.

- Complete the Expenses section. Motor vehicle expenses flow from the MotorVehicle worksheet.

- If a portion of the expenses apply to personal use, enter a percentage at the top of the Personal portion column.

- Answer Yes or No in the Apply column on the right to apply the prorated calculation of personal-use to each expense line.

Co-owner or Partner

Amounts are claimed differently depending on whether the taxpayer is a co-owner or a partner. For example, proportionate amounts based on percentage of ownership for co-owners are calculated at line 5 and allocated share of other costs (including CCA at line 9936) are entered in subsequent lines.

To help you choose the right type for your client, the CRA Rental Income guide states:

“Most of the time, if you own the rental property with one or more persons, we consider you to be a co-owner. For example, if you own a rental property with your spouse or common-law partner, you are a co-owner.

In some cases, if you are a co-owner, you have to determine if a partnership exists. A partnership is a relationship between two or more people carrying on a business, with or without a written agreement, to make a profit. If there is no business in common, there is no partnership. That is, co-ownership of a rental property as an investment does not make a partnership. To help you determine if you are in a partnership, see the partnership law for your province or territory. For more information, see Income Tax Folio S4-F16-C1, What is a Partnership?"

Capital Cost Allowance (CCA)

See the T1 CCA and Assets Forms help topics for instructions on completing CCA worksheets.

CCA cannot create a loss on a rental statement. Depreciation is taken only to reduce income to zero.

CCA tables are not shared between spouses with co-owned T776 statements. You must divide the amounts in half and enter them on a T776Asset for each spouse. This is because co-owners’ income is split BEFORE deducting the CCA. Whereas in a partnership, CCA is deducted from the total income before splitting the net income between partners.

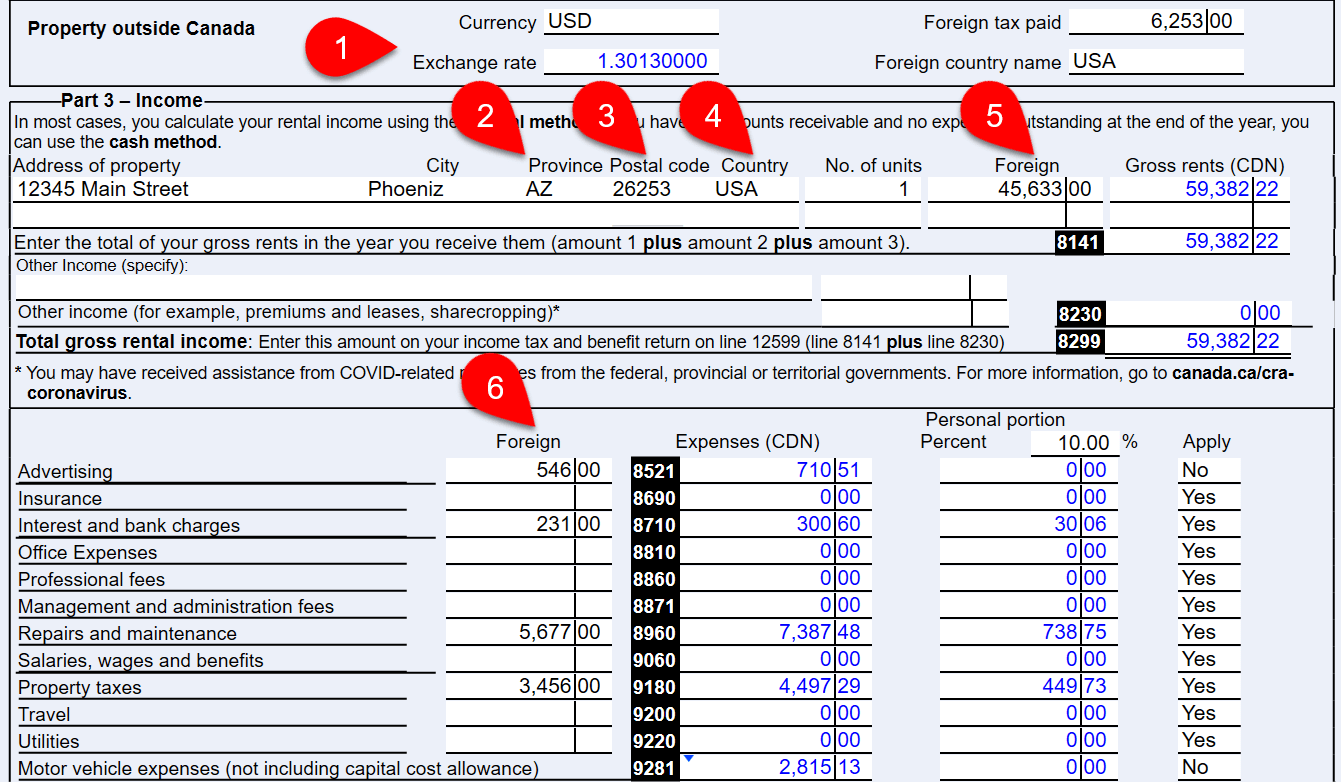

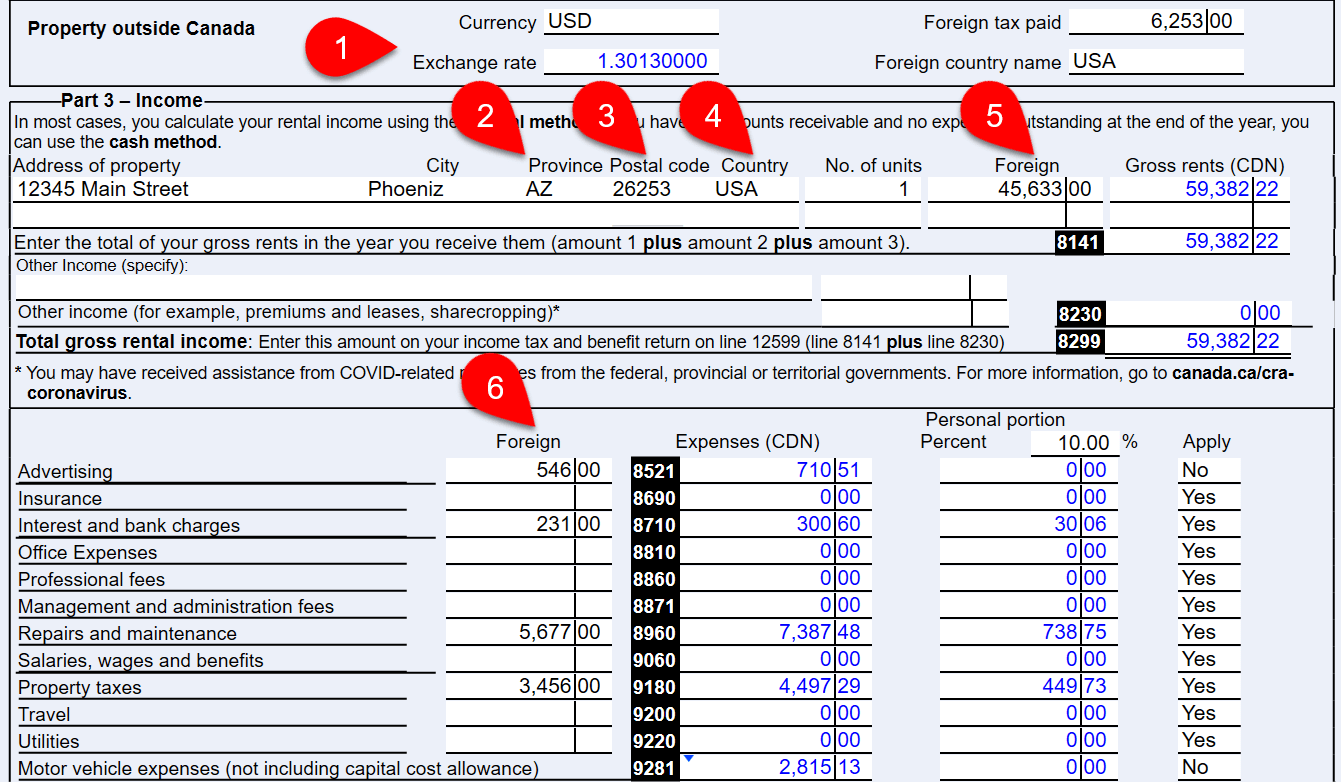

Foreign Rental Properties

- Complete the Property outside Canada section, entering the currency, any foreign tax paid and the country name. TaxCycle will automatically apply the exchange rate and use the country name to create any foreign tax credit forms.

- Enter the foreign address for the property. The Province list includes US states.

- To enter a foreign Postal code, press Ctrl+F2 to override the format. Regardless what you enter in this field, when you EFILE the return, TaxCycle automatically sends taxpayer’s postal code, as this is what the CRA requires.

- Select the Country.

- In the Foreign column, enter gross rents in the foreign currency. TaxCycle automatically converts them to Canadian dollars.

- In the Foreign column, enter expenses in the foreign currency. TaxCycle automatically converts them to Canadian dollars.