Updated: 2023-11-14

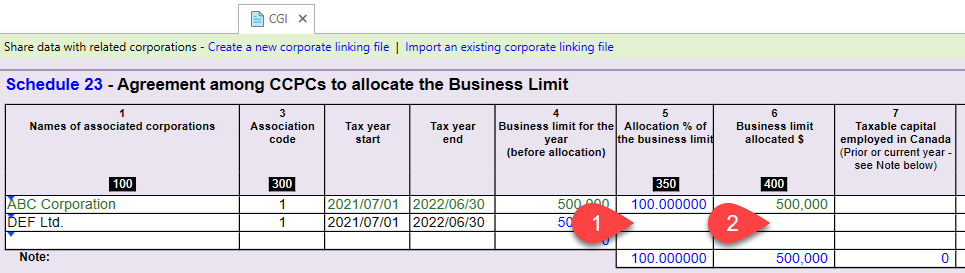

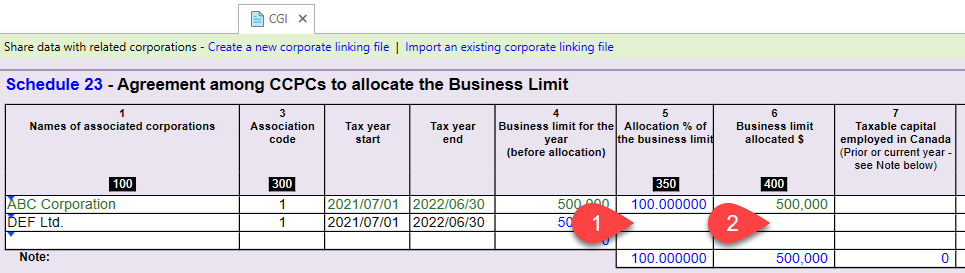

Enter information about associated/related corporations on the Corporate Group Information (CGI) worksheet and TaxCycle T2 will automatically transfer it to the Schedule 9 (S9) and Schedule 23 (S23). This means you can add or revise associated/related corporation data wherever you choose and the information will flow to the other forms.

Corporate Group Information (CGI) Worksheet

To make data entry more efficient, the CGI worksheet is a single form with expandable tables.

For example, when you allocate small business deductions, you can make the allocations to all of the associated corporations in one single table, with absolutely no scrolling from one record to another.

Small Business Deduction Allocation

Allocate the small business deduction on the S23 or the CGI worksheet, depending on which method works best for you.

- If you would like to allocate a small business deduction to an associated corporation by a percentage, enter the percentage allocated to the associated corporation and TaxCycle will calculate the dollar amount.

- If you prefer to allocate by dollar amount, enter the amount allocated to the associated corporation and TaxCycle will calculate the percentage.

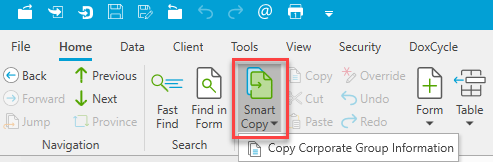

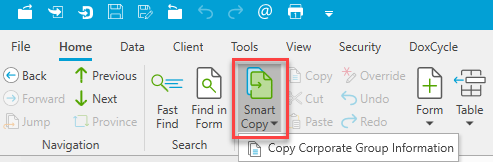

Corporate Linking and Smart Copy/Paste

If you are preparing returns for more than one of the associated/related corporations, you can link those files to share the information between them. Learn how in the Corporate Linking help topic.

For a one-time copy/paste of the CGI worksheet, use Smart Copy/Paste.