Updated: 2023-11-13

In the 2018 Federal Fall Economic Statement, the federal Minister of Finance introduced the Accelerated Investment Incentive (AII). This measure allows Canadian businesses to write off a larger share of the cost of newly acquired depreciable assets (tangible and intangible) in the year the investment is made.

The changes affect Capital Cost Allowance (CCA) calculations in 2018 T1 returns, as well as T2, T3 and T5013 returns with fiscal years ending after November 20, 2018. The federal and provincial rules described below will be in force until 2024, when transitional rules will take over. For Alberta AT1 returns, the same federal rules apply to the accelerated CCA calculations. For Québec TP1, CO-17 and TP-600 returns, the same federal rules apply in general, with some adaptations. Please review the Québec section of this article to learn more.

Rules and Examples

Status of Accelerated CCA calculations in TaxCycle

We have updated TaxCycle T1/TP1, T2/CO-17, T3/TP-646 and T5013/TP-600 Accelerated CCA forms and calculations. See below for instructions:

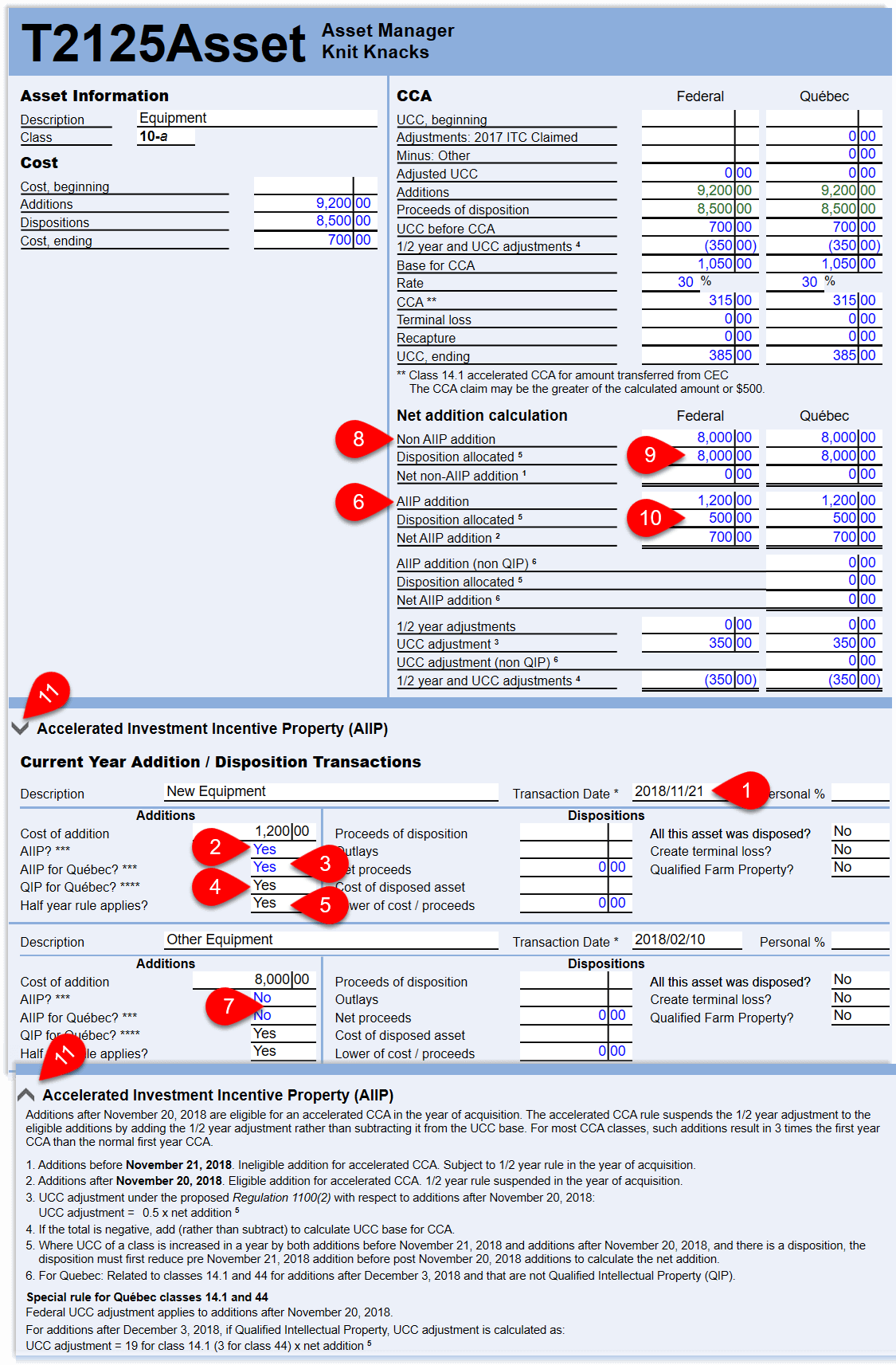

T1/TP1 and T3/TP-646: Calculation of Accelerated CCA on Asset Managers

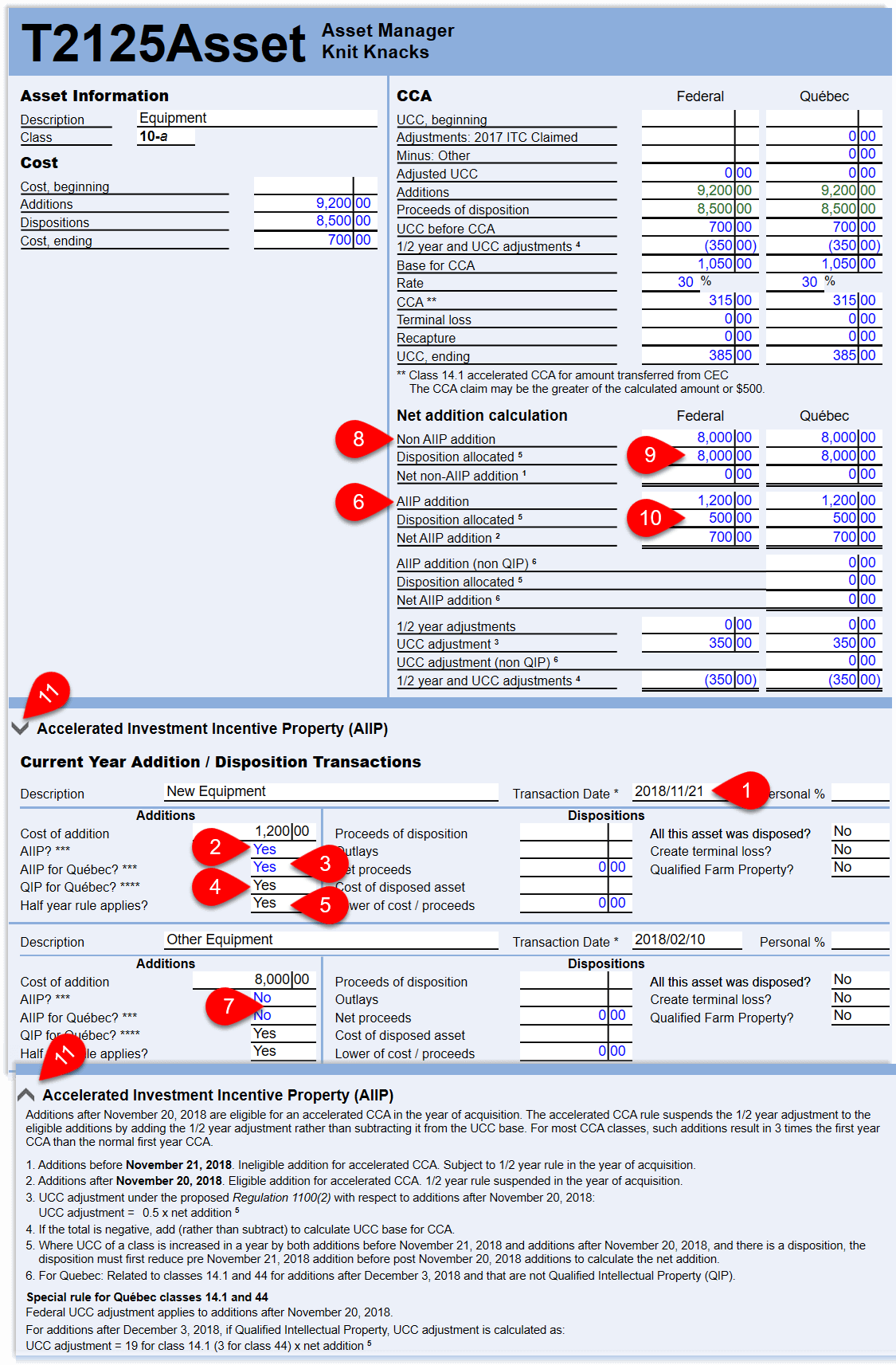

In TaxCycle T1/TP1 and T3/TP-646, related sections, fields and questions appear on the asset manager to calculate accelerated CCA and explain the applicable rules. These forms are part of the income statement form set. For example T2125Asset:

- If the fiscal year of a business ends after November 20, 2018, you must enter the date of purchase in the Transaction date field when entering an addition. TaxCycle uses this date to determine if the addition is eligible for accelerated CCA.

- If you enter a transaction date that is after November 20, 2018, TaxCycle answers Yes to the AIIP? question. This indicates that the addition is eligible for an accelerated CCA. If you open an existing file and do not have a transaction date on a current-year addition, the answer to the AIIP question remains No until you enter an eligible date.

- TaxCycle also automatically answers Yes to the Québec AIIP? question when the Québec measures apply to the addition. (Note: Québec class 50 additions after November 20, 2018 are subject to the federal Accelerated Investment Incentive Property rule. A special Québec rule applies to additions after December 3, 2018. See Québec Special Rules for Class 50, below.)

- For additions to Québec classes 14, 14.1 and 44 made after November 20, 2018, generally, federal Accelerated Investment Incentive Property rule applies. However, for additions after December 3, 2018, if the acquired property is a Qualified Intellectual Property (QIP), then a special Québec rule applies. (See Québec Special Rules for Classes 14, 14.1 and 44, below.) To apply the special rule in this case, answer Yes to the QIP for Québec? question in the Current Year Addition/Disposition Transactions section.

- IMPORTANT! Generally, the half-year rule is suspended for an eligible addition. This occurs automatically in TaxCycle when calculating the accelerated CCA. DO NOT answer NO to the half-year rule question on the asset manager to achieve this result. Answer the question based on whether the half-year rule would apply in normal circumstances and TaxCycle will take care of the rest.

- Eligible additions are transferred to the AIIP addition row in the Net addition calculation section of the asset manager, and a corresponding UCC bump-up is calculated.

- If the transaction date is before November 21, 2018, the addition is not eligible for accelerated CCA. TaxCycle answers the AIIP? with No. This indicates that the addition is not eligible for an accelerated CCA.

- Ineligible additions are transferred to the Non AIIP addition row in the Net addition calculation section of the asset manager, and any applicable half-year adjustment is calculated.

- When you enter a disposition, TaxCycle first applies the amount to any Non AIIP additions.

- If there is a remaining disposition amount, it is then applied to AIIP additions.

- For additional information about the calculations, refer to the Accelerated Investment Incentive Property (AIIP) section which explains the applicable rule and calculation. This section changes based on the Class of the asset selected at the top of the asset manager. To collapse/hide or expand/show the notes in the Accelerated Investment Incentive Property (AIIP) section, click the arrow on the far left of the section title.

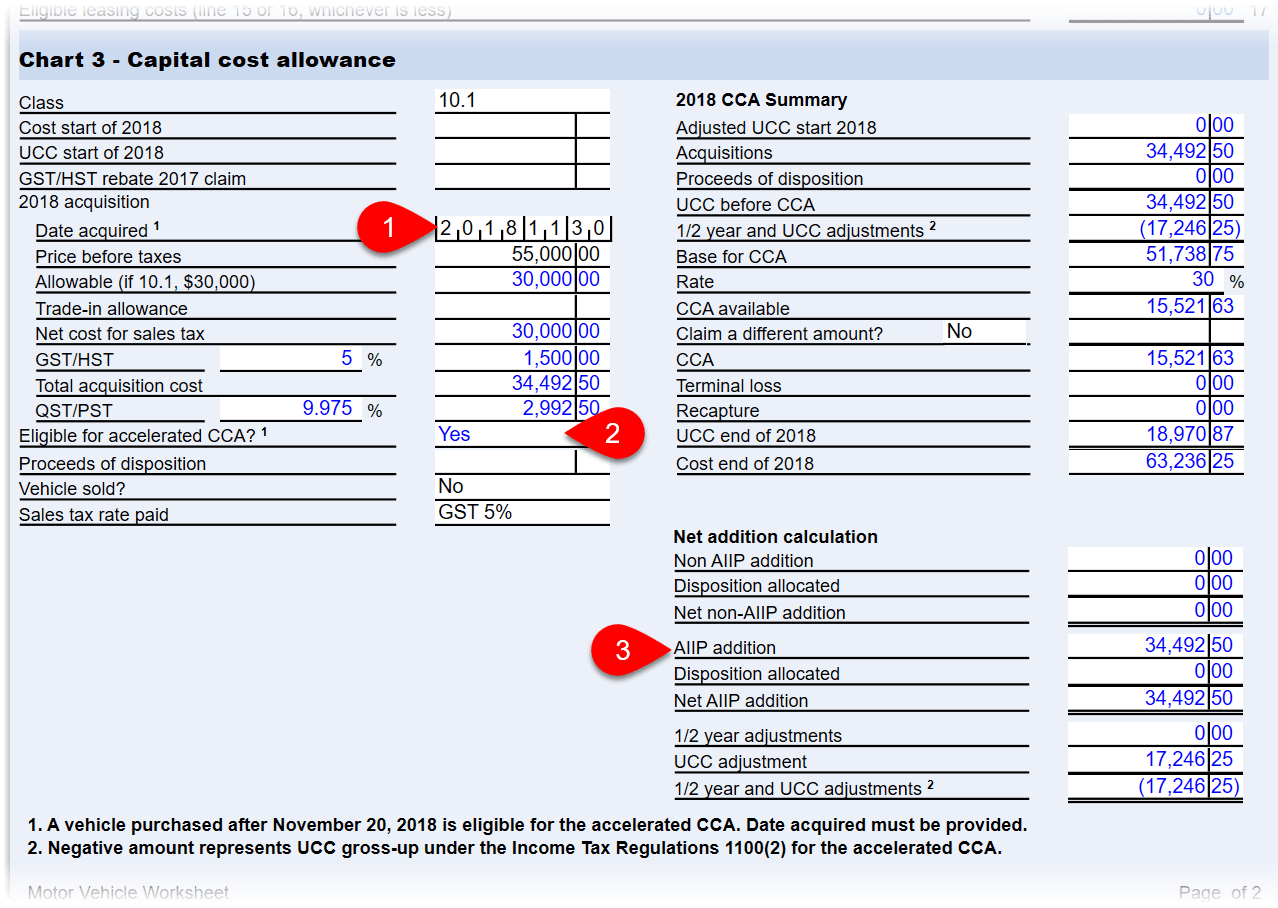

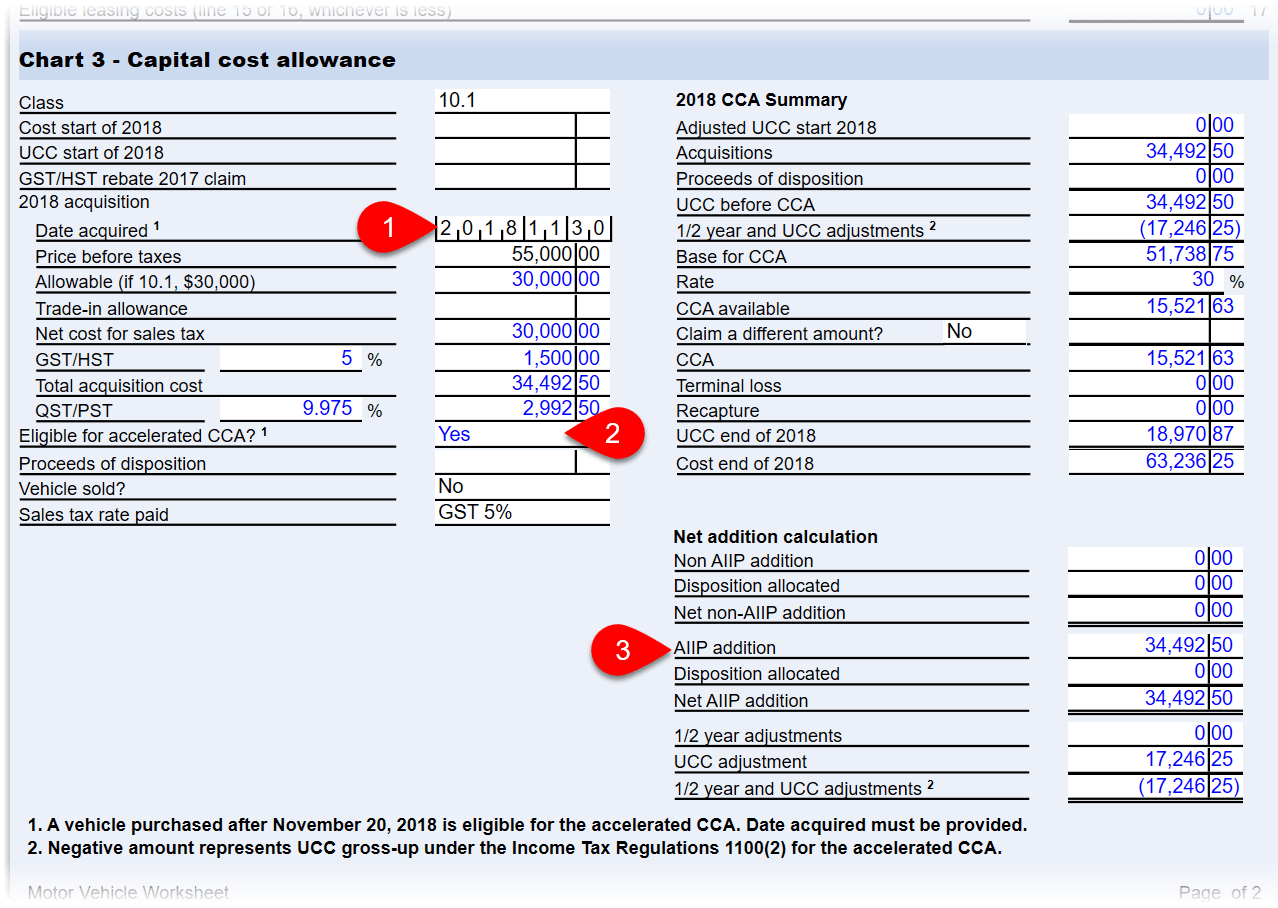

T1/TP1: Motor Vehicle Worksheet

To claim Accelerated CCA on a motor vehicle, go to Chart 3 on the Motor Vehicle worksheet:

- Enter the acquisition date. When adding a new motor vehicle, you must enter an acquisition date so that TaxCycle can determine whether the addition is eligible for accelerated CCA. If the date is blank, you will see a review message reminding you to complete the field.

- If the addition was before November 21, 2018, the addition is not eligible for the accelerated CCA. If the date is after November 20, 2018, TaxCycle will automatically answer Yes to the Eligible for accelerated CCA? question and trigger the accelerated CCA calculations. If you do not wish to apply accelerated CCA, override the answer to No.

- When applicable, rows in the Net addition calculation table show the calculation of the UCC bump-up for the purposes of accelerated CCA, similar to those on the asset manager.

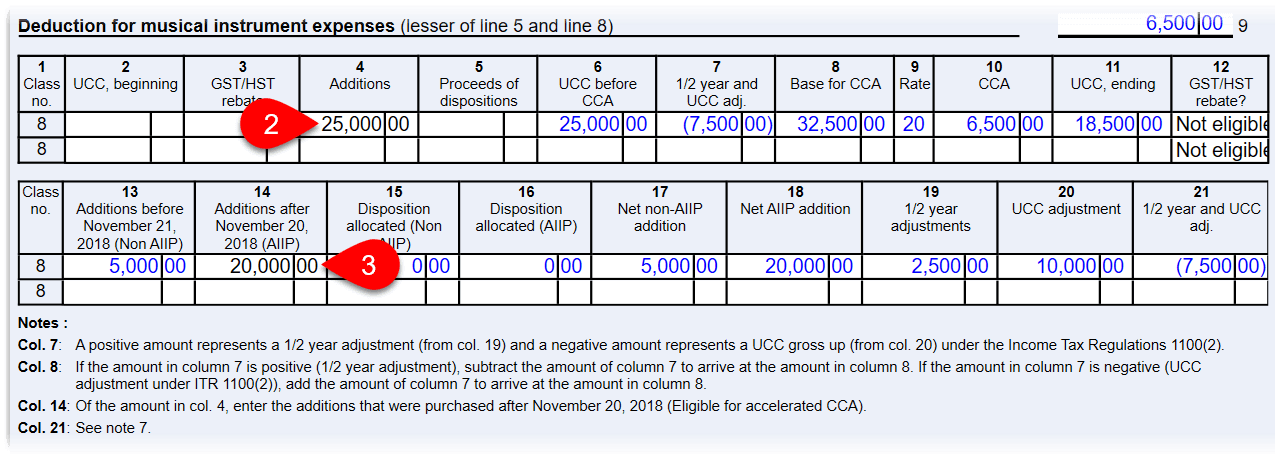

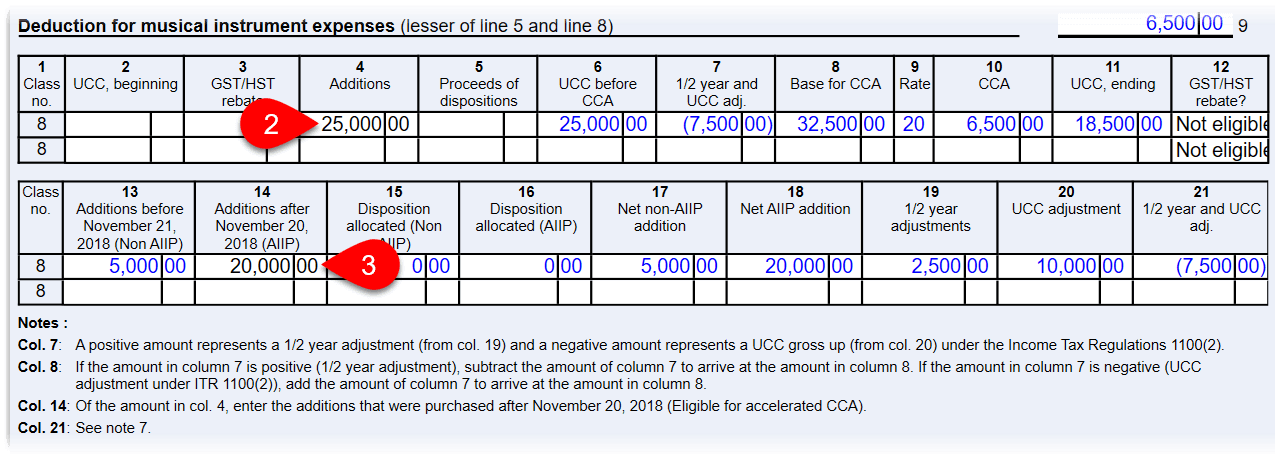

T1/TP1: T777WS for Employment Expenses

To claim accelerated CCA on the T777WS for expenses of employed artists:

- Go the CCA table in the Expenses of employed artists section.

- Enter the amount of the addition in column 4.

- In column 14, enter the portion of the amount from column 4 that was acquired after November 20, 2018. This amount is then used to calculation the accelerated CCA.

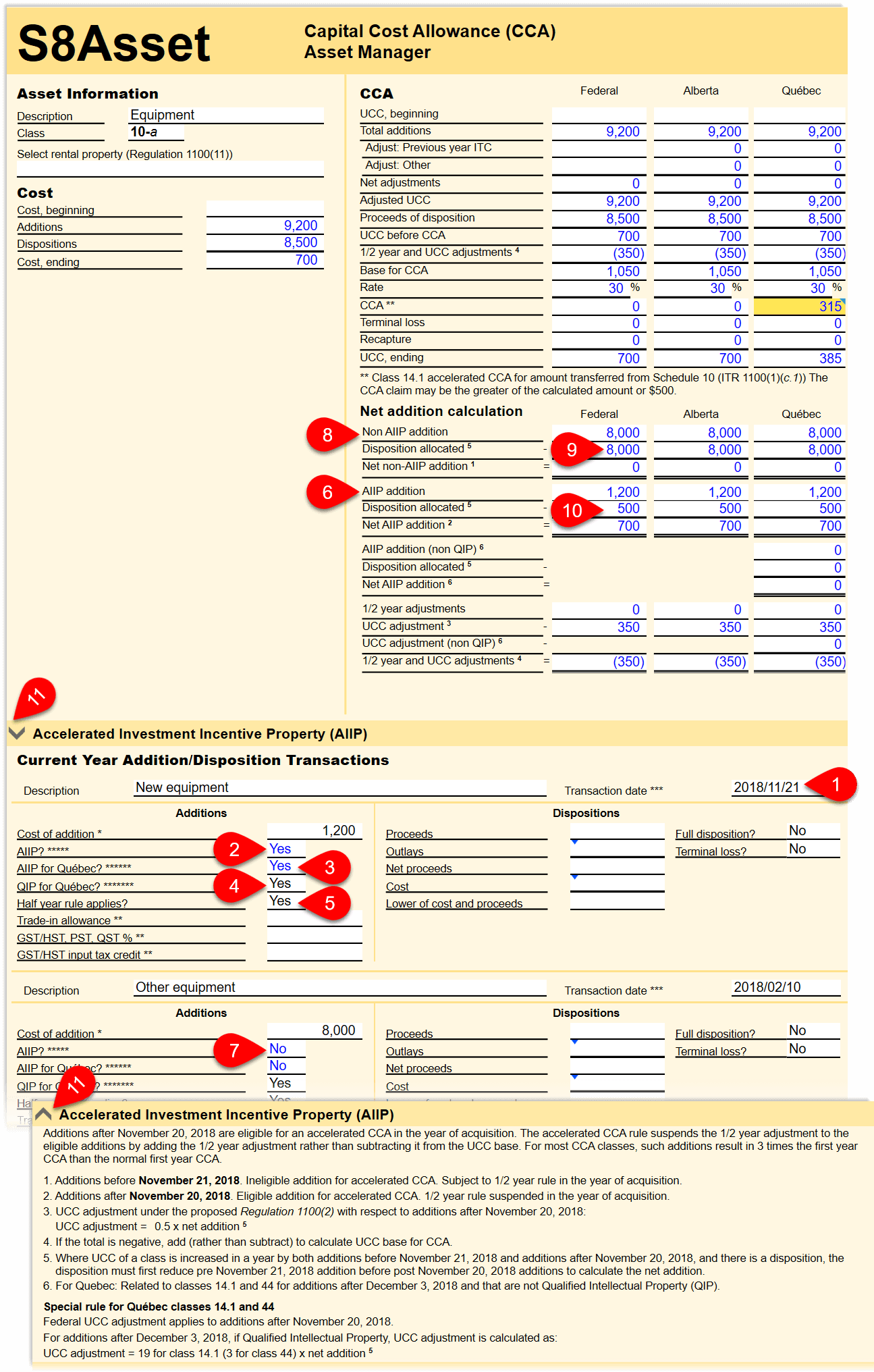

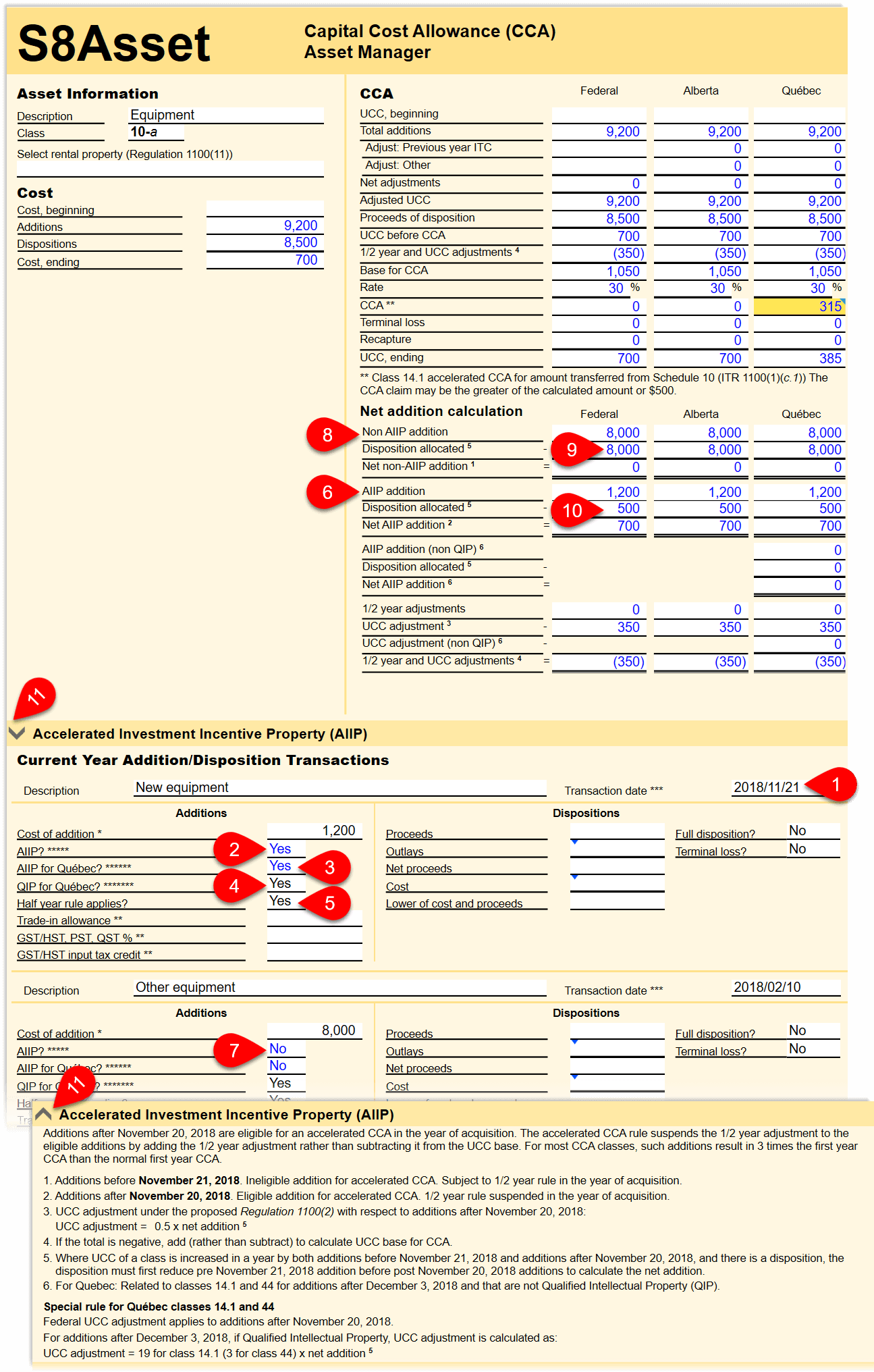

T2/CO-17 and T5013/TP-600: Calculation of Accelerated CCA on the S8Asset

In TaxCycle T2/CO-17 and TaxCycle T5013/TP-600, related sections, fields and questions appear on the S8Asset asset manager to calculate accelerated CCA and explain the applicable rules:

- If the tax year of a corporation ends after November 20, 2018, you must enter the date of purchase in the Transaction date field when entering an addition. TaxCycle uses this date to determine if the addition is eligible for accelerated CCA.

- If you enter a transaction date that is after November 20, 2018, TaxCycle answers Yes to the AIIP? question. This indicates that the addition is eligible for an accelerated CCA. If you open an existing file and do not have a transaction date on a current-year addition, the answer to the AIIP question remains No until you enter an eligible date.

- TaxCycle also automatically answers Yes to the Québec AIIP? question when the Québec measures apply to the addition. (Note: Québec class 50 additions after November 20, 2018 are subject to the federal Accelerated Investment Incentive Property rule. A special Québec rule applies to additions after December 3, 2018. See Québec Special Rules for Class 50, below.)

- For additions made to Québec classes 14, 14.1 and 44 after November 20, 2018, generally, federal Accelerated Investment Incentive Property rule applies. However, for additions after December 3, 2018, if the acquired property is a Qualified Intellectual Property (QIP), then a special Québec rule applies. (See Québec Special Rules for Classes 14, 14.1 and 44, below.) To apply the special rule in this case, answer Yes to the QIP for Québec? question in the Current Year Addition/Disposition Transactions section.

- IMPORTANT! Generally, the half-year rule is suspended for an eligible addition. This occurs automatically in TaxCycle when calculating the accelerated CCA. DO NOT answer NO to the half-year rule question on the asset manager to achieve this result. Answer the question based on whether the half-year rule would apply in normal circumstances and TaxCycle will take care of the rest. For example, you should still answer No when a taxpayer is adding a property excluded from the half-year rule.

- Eligible additions are transferred to the AIIP addition row in the Net addition calculation section of the asset manager, and a corresponding UCC bump-up is calculated.

- If the transaction date is before November 21, 2018, the addition is not eligible for accelerated CCA. TaxCycle answers the AIIP? with No. This indicates that the addition is not eligible for an accelerated CCA.

- Ineligible additions are transferred to the Non AIIP addition row in the Net addition calculation section of the asset manager, and any applicable half-year adjustment is calculated.

- When you enter a disposition, TaxCycle first applies the amount to any Non AIIP additions.

- If there is a remaining disposition amount, it is then applied to AIIP additions.

- For additional information about the calculations, refer to the Accelerated Investment Incentive Property (AIIP) section which explains the applicable rule and calculation. This section changes based on the Class of the asset selected at the top of the asset manager. To collapse/hide or expand/show the notes in the Accelerated Investment Incentive Property (AIIP) section, click the arrow on the far left of the section title.

Related Government Documents

General Rule

Property eligible for accelerated CCA is called “Accelerated Investment Incentive Property” (AIIP). AIIP is depreciable property purchased by a taxpayer after November 20, 2018, and which must become available for use before 2028. In general, AIIP is not subject to the half-year rule, and it is eligible for CCA equal to three times the normal first-year CCA.

In addition, the following conditions must both be met in order to qualify as AIIP:

- neither the taxpayer nor a non-arm’s-length person can have previously-owned the property; and

- the property cannot have been transferred to the taxpayer on a tax-deferred “rollover” basis.

For additions made after November 20, 2018 and before 2024, the half-year adjustment is suspended and the Undepreciated Capital Cost (UCC) base is increased by 50% of the “net” acquisition cost for the purposes of calculating CCA in the year of acquisition.

Where UCC of a class is increased in a year by both additions before November 21, 2018 and additions after November 20, 2018, and there is a disposition at any time during the tax year, the disposition must first reduce pre-November 21, 2018 addition before post-November 20, 2018 additions to calculate the net addition.

For additions after 2023 and before 2028, a transitional rule applies.

Example: General Rule

Applicable to all classes except classes 13, 14, 43.1, 43.2 and 53 (and 14, 14.1, 44 and 50 for Québec)

Tax year: January 1, 2018 to December 31, 2018

Class 8 addition on March 18, 2018 (not eligible for accelerated CCA): $500

Class 8 addition on November 21, 2018 (eligible accelerated for CCA): $1,000

Opening UCC: $2,550 |

| Normal CCA |

Accelerated CCA |

| Opening UCC |

$2,550 |

$2,550 |

| Addition before November 21, 2018 |

$500 |

$500 |

| Addition after November 20, 2018 |

$1,000 |

$1,000 |

| Adjusted UCC |

$4,050 |

$4,050 |

| Half-year adjustment |

($750) |

($250)1 |

| UCC adjustment |

n/a |

$5002 |

| UCC base for CCA |

$3,300 |

$4,300 |

| CCA rate |

20% |

20% |

| CCA |

$660 |

$860 |

| Ending UCC |

$3,390 |

$3,190 |

Notes:

1. Half-year adjustment:

Pre November 21, 2018 addition: $500 x 50% = $250

Post November 20, 2018 addition: suspended

2. UCC adjustment: post November 20, 2018 addition of $1,000 x 50% |

General Rule—Straddle years (2023-2026)

Example: General Rule for a CCPC—Straddle years (2023-2026)

Applicable to all classes.

If a taxation year begins in 2023 and ends in 2024 or if a taxation year begins in 2025 and ends in 2026, a special rule applies to calculate the UCC adjustment.

Tax year: July 1, 2023 to June 30, 2024

Corporation type: CPCC

Class 10 on December 31, 2023: $12,000

Class 10 addition on January 1, 2024: $24,000

Amount immediately expensed under immediate expensing rule: $12,000 |

| CCPC Accelerated CCA |

| Opening UCC |

$2,550 |

| Addition on December 31, 2023 |

$12,000 |

| Addition on January 1, 2024 |

$24,000 |

| Adjusted UCC |

$38,550 |

| Half-year adjustment |

n/a |

| Immediately expensed |

-$12,000 |

| UCC adjustment |

-1 |

| UCC base for CCA |

$26,550 |

| CCA rate |

30% |

| CCA |

$19,965 |

| Ending UCC |

$18,585 |

Notes:1. Per Income Tax Act Regulations 1100(2.01)—Straddle years

If a taxation year begins in 2023 and ends in 2024, the factor used to calculate UCC adjustment is calculated as:

(A(B) + C(D))/(B + D)where

A is the UCC adjustment factor for 2023 (factor of 0.5),

B is the amount of addition in 2023 ($0 since $12,000 is immediately expensed),

C is the UCC adjustment factor for 2024 (factor of 0), and

D is the amount of addition in 2024 ($24,000)

UCC adjustment factor = ((0.5 x $0) + (0 x $24,000)) / ($0 + $24,000) = 0

UCC adjustment = Factor of 0 x $24,000 = $0

Example: General Rule for a non-CCPC—Straddle years (2023-2026)

Applicable to all classes.

If a taxation year begins in 2023 and ends in 2024 or if a taxation year begins in 2025 and ends in 2026, a special rule applies to calculate the UCC adjustment.

Tax year: July 1, 2023 to June 30, 2024

Corporation type: Public corporation (Not eligible for immediate expensing of CCA)

Class 10 addition on December 31, 2023: $12,000

Class 10 addition on January 1, 2024: $24,000

Amount immediately expensed under immediate expensing rule: $12,000 |

| Non-CCPC Accelerated CCA |

| Opening UCC |

$2,550 |

| Addition on December 31, 2023 |

$12,000 |

| Addition on January 1, 2024 |

$24,000 |

| Adjusted UCC |

$38,550 |

| Half-year adjustment |

n/a |

| Immediately expensed |

- |

| UCC adjustment |

$60001 |

| UCC base for CCA |

$44,550 |

| CCA rate |

30% |

| CCA |

$13,365 |

| Ending UCC |

$25,185 |

Notes:1. Per Income Tax Act Regulations 1100(2.01)—Straddle years

If a taxation year begins in 2023 and ends in 2024, the factor used to calculate UCC adjustment is calculated as:

(A(B) + C(D))/(B + D)where

A is the UCC adjustment factor for 2023 (factor of 0.5),

B is the amount of addition in 2023 ($12,000),

C is the UCC adjustment factor for 2024 (factor of 0), and

D is the amount of addition in 2024 ($24,000)

UCC adjustment factor = ((0.5 x $12,000) + (0 x $24,000)) / ($12,000 + $24,000) = 0.166667

UCC adjustment = Factor of 0.166667 x $36,000 = $6,000

Federal Special Rules

Class 13

In the year of acquisition, a new leasehold acquired after November 20, 2018 and before 2024 is eligible for 150% of the amount calculated in accordance with Schedule III of the Income Tax Act Regulation, and the half-year rule is suspended. For additions made after 2023 and before 2028, a transitional rule applies.

Example: Class 13

Tax year: January 1, 2018 to December 31, 2018

Leasehold interest: $210,000

Lease term: November 21, 2018 to November 20, 2023

(Five 12-month periods at an annual CCA of $42,000) |

| Normal CCA |

Accelerated CCA |

| Addition |

$210,000 |

$210,000 |

| Half-year adjustment |

n/a1 |

n/a |

| UCC adjustment |

n/a |

n/a |

| UCC base for CCA |

$210,000 |

$210,000 |

| CCA rate |

n/a |

n/a |

| CCA |

$21,0002 |

$63,0003 |

| Ending UCC |

$189,000 |

$147,000 |

Notes:

1. Half-year adjustment made directly to CCA.

2. $210,000/5 periods x half-year rule = $21,000

3. $210,000/5 periods x 150% = $63,000 (half-year rule suspended) |

Class 14

In the year of acquisition, a taxpayer is eligible for an additional 50% CCA for an intangible asset acquired after November 20, 2018 and before 2024. For additions made after 2023 and before 2028, a transitional rule applies.

Example: Class 14

Tax year: January 1, 2018 to December 31, 2018

Class 14 addition on November 21, 2018 (eligible for accelerated CCA): $100,000

Life of the intangible asset: November 21, 2018 to November 20, 2025 (2,557 days)

Number of days of amortization from date of purchase to tax year-end: 41 days |

| Normal CCA |

Accelerated CCA |

| Addition |

$100,000 |

$100,000 |

| Half-year adjustment |

n/a1 |

n/a |

| UCC adjustment |

n/a |

n/a |

| UCC base for CCA |

$100,000 |

$100,000 |

| CCA rate |

n/a |

n/a |

| CCA |

$1,6032 |

$2,4053 |

| Ending UCC |

$98,397 |

$97,595 |

Notes:

1. Half-year adjustment does not apply to class 14.

2. $100,000/2,557 days x 41 days = $1,603

3. $100,000/2,557 days x 41 days x 150% = $2,405 |

Classes 43.1, 43.2 and 53

A special rule applies to manufacturing and processing equipment to allow it to be fully written off. For an acquisition made after November 20, 2018 and before 2024, in the year of acquisition, the half-year adjustment is suspended and 100% of the cost of the addition can be claimed as CCA. For class 43.1, the UCC is increased by 7/3 of the cost of acquisition in the year of acquisition. For classes 43.2 and 53, the UCC is increased by 100% of the cost of acquisition in the year of acquisition.

Example: Class 43.1

Tax year: January 1, 2018 to December 31, 2018

Class 43.1 addition on November 21, 2018 (eligible for accelerated CCA): $100,000 |

| Normal CCA |

Accelerated CCA |

| Addition |

$100,000 |

$100,000 |

| Half-year adjustment |

($50,000) |

n/a |

| UCC adjustment |

n/a |

$233,3331 |

| UCC base for CCA |

$50,000 |

$333,333 |

| CCA rate |

30% |

30% |

| CCA |

$15,000 |

$100,000 |

| Ending UCC |

$85,000 |

$0 |

Notes:

1. $100,000 x 7/3 |

Example: Class 43.2 and 53

Tax year: January 1, 2018 to December 31, 2018

Class 43.2/53 addition on November 21, 2018 (eligible for accelerated CCA): $100,000 |

| Normal CCA |

Accelerated CCA |

| Addition |

$100,000 |

$100,000 |

| Half-year adjustment |

($50,000) |

n/a |

| UCC adjustment |

n/a |

$100,0001 |

| UCC base for CCA |

$50,000 |

$200,000 |

| CCA rate |

50% |

50% |

| CCA |

$25,000 |

$100,000 |

| Ending UCC |

$75,000 |

$0 |

Notes:

1. $100,000 x 100% |

Québec Special Rules

Québec Special Rules for Classes 14, 14.1 and 44

- Classes 14, 14.1 and 44, additions made after November 20, 2018 are subject to the same federal rules.

- Additions of Qualified Intellectual Property made after December 3, 2018, are permitted a full write-off of costs of the asset.

Qualified Intellectual Property

Qualified intellectual property means property acquired after December 3, 2018, that is a patent or a right to use patented information, a licence, a permit, know-how, a commercial secret or other similar property constituting knowledge, and that:

- is property included in Class 14 of Schedule B to the Regulation respecting the Taxation Act, property included in Class 44 of that schedule or property that is incorporeal capital property;

- is acquired by a taxpayer in the course of a technology transfer or is developed by or on behalf of the taxpayer with a view to enabling the taxpayer to implement an innovation or invention concerning the taxpayer’s business;

- begins to be used within a reasonable time after being acquired or after its development is completed;

- is used, for the period covering the process of implementing the innovation or invention (hereinafter, “implementation period”), only in Québec and primarily in the course of carrying on a business by the taxpayer or, where applicable, by a person with whom the taxpayer does not deal at arm’s length and who acquired the property in circumstances in which a transfer, amalgamation or winding-up occurred;

- is not, for the implementation period, property used for earning or producing gross revenue consisting of rent or royalty;

- is not property acquired from a person or partnership with which the taxpayer does not deal at arm’s length.

Qualified intellectual property does not include a trade mark, an industrial design, a copyright or other similar property constituting the expression of knowledge. The expression “technology transfer” means the transmission to a taxpayer of knowledge in the form of know-how, techniques, processes or formulas, with a view to enabling the taxpayer to implement an innovation or invention concerning the taxpayer’s business.

In addition, intellectual property will be deemed to be used only in Québec where it is used as part of the process of implementing an innovation or invention and where the efforts to implement that innovation or invention are made only in Québec.

More specifically, if at any time in the implementation period, an event occurs that prevents one of the conditions allowing intellectual property to be qualified intellectual property from being met, the intellectual property will not be qualified intellectual property.

Québec Special Rules for Class 50

- Class 50 additions made after November 20, 2018 and before December 4, 2018, are subject to the same federal rules.

- Additions made after December 3, 2018 are eligible for a UCC gross up of 9/11 times the net addition.

Class 14 for Québec – Qualified Intellectual Property

Additions of Qualified Intellectual Property made after December 3, 2018 are eligible for CCA equal to the full cost of the addition.

Example: Class 14 for Québec – Qualified Intellectual Property

Tax year: January 1, 2018 to December 31, 2018

Class 14 addition on December 4, 2018 (eligible for accelerated CCA): $100,000

Life of the intangible asset: December 4, 2018 to December 2, 2025 (2,557 days)

Number of days of amortization from date of purchase to tax year-end: 28 days |

| Normal CCA |

Accelerated CCA |

| Addition |

$100,000 |

$100,000 |

| Half-year adjustment |

n/a1 |

n/a |

| UCC adjustment |

n/a |

n/a |

| UCC base for CCA |

$100,000 |

$100,000 |

| CCA rate |

n/a |

n/a |

| CCA |

$1,0952 |

$100,0003 |

| Ending UCC |

$98,397 |

$0 |

Notes:

1. Half-year adjustment does not apply to class 14.

2. $100,000/2,557 days x 28 days = $1,095

3. $100,000 |

Class 14.1 for Québec – Qualified Intellectual Property

Additions of Qualified Intellectual Property made after December 3, 2018 are eligible for full write-off. The half-year rule is suspended and UCC is increased by an amount equal to 19 times the net addition, resulting in accelerated CCA equal to the full cost of the addition.

Example: Class 14.1 for Québec – Qualified Intellectual Property

Tax year: January 1, 2018 to December 31, 2018

Class 14.1 addition on December 4, 2018 (eligible for accelerated CCA): $100,000 |

| Normal CCA |

Accelerated CCA |

| Addition |

$100,000 |

$100,000 |

| Half-year adjustment |

($50,000) |

n/a |

| UCC adjustment |

n/a |

$1,900,0001 |

| UCC base for CCA |

$50,000 |

$2,000,000 |

| CCA rate |

5% |

5% |

| CCA |

$2,500 |

$100,000 |

| Ending UCC |

$97,500 |

$0 |

Notes:

1. $100,000 x 19 |

Class 44 for Québec – Qualified Intellectual Property

Additions of Qualified Intellectual Property made after December 3, 2018 are eligible for accelerated CCA. The half-year rule is suspended and UCC is increased by an amount equal to three times the net addition, resulting in accelerated CCA equal to the full cost of the addition.

Example: Class 44 for Québec

Tax year: January 1, 2018 to December 31, 2018

Class 44 addition on December 4, 2018 (eligible for accelerated CCA): $100,000 |

| Normal CCA |

Accelerated CCA |

| Addition |

$100,000 |

$100,000 |

| Half-year adjustment |

($50,000) |

n/a |

| UCC adjustment |

n/a |

$300,0001 |

| UCC base for CCA |

$50,000 |

$4,000,000 |

| CCA rate |

25% |

25% |

| CCA |

$12,500 |

$100,000 |

| Ending UCC |

$87,500 |

$0 |

Notes:

1. $100,000 x 3 |

Class 50 for Québec

Additions made after December 3, 2018 are eligible for accelerated CCA. The half-year rule is suspended and UCC is increased by an amount equal to 9/11 times the net addition, resulting in accelerated CCA equal to the full cost of addition.

Example: Class 50 for Québec

Tax year: January 1, 2018 to December 31, 2018

Class 50 addition on December 4, 2018 (eligible for accelerated CCA): $100,000 |

| Normal CCA |

Accelerated CCA |

| Addition |

$100,000 |

$100,000 |

| Half-year adjustment |

($50,000) |

n/a |

| UCC adjustment |

n/a |

$81,8181 |

| UCC base for CCA |

$50,000 |

$181,818 |

| CCA rate |

55% |

55% |

| CCA |

$27,500 |

$100,000 |

| Ending UCC |

$72,500 |

$0 |

Notes:

1. $100,000 x 9/11 |