Updated: 2024-11-19

If you used DoxCycle along with TaxCycle, you have a tidy PDF file containing all the source documents and the return as filed for each client. This prepares you to respond quickly and electronically to any request for further information from the Canada Revenue Agency (CRA).

As a tax preparer, you can Submit documents online to the CRA on behalf of your clients. All you need to do is open your DoxCycle file and then upload the requested items. These can include supporting documents for home office expenses, child care payments, donation receipts, investment statements, motor vehicle logs, prescription receipts and medical expenses.

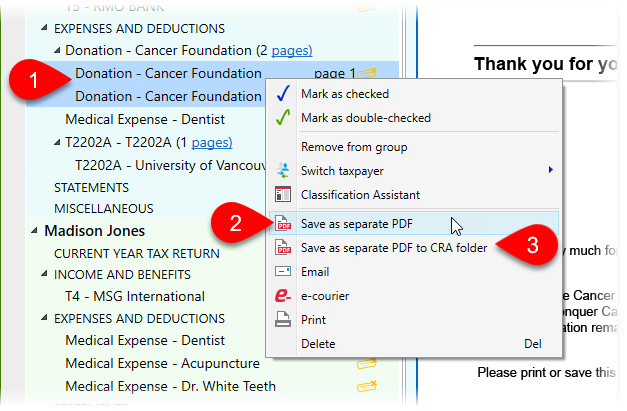

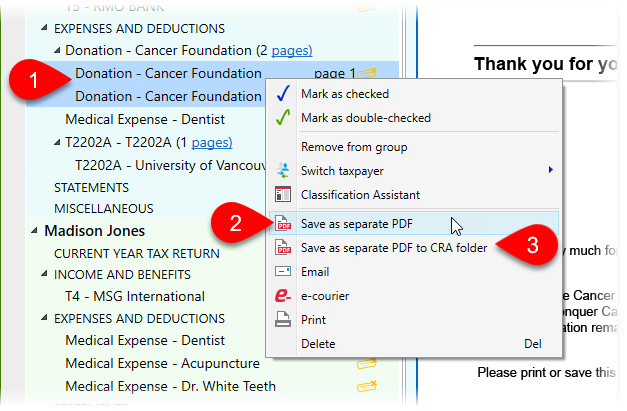

Save a separate PDF from DoxCycle

DoxCycle makes it easy to gather those documents for upload:

- Press and hold the Ctrl key and click on each document you want to submit to the CRA. (Or, press and hold the Shift key and click to select a range of documents.)

- Right-click on the selected documents, then select Save as separate PDF.

- Select Save as a separate PDF to CRA folder to save it to the CRA folder specified in options.

- Enter a file name and save the file. Remember where you saved it because you will need to find it again when you submit the documents online.

Submit documents online to the CRA

The CRA accepts files of a maximum of 150MB in the following formats: pdf, doc, docx, xls, xlsx, rtf, txt, jpg, jpeg, tiff, tif, xps. The file you created is in the PDF format, so it is acceptable. However, if your PDF is too large, you can create separate files from DoxCycle. Just make sure that each file has a unique name.

Do not submit documents electronically if requested information has already been sent via mail or facsimile. Duplicate submissions may delay processing.

Once you have your file or files, you are ready to upload:

- Open your web browser and log in to Represent a Client.

- In the menu, click on Submit documents.

- Follow the instructions to select a client or program type and enter a case or reference number if you have one. Then select the appropriate document type from the list. (If the task you wish to complete is not included on the list, you will need to send your documents by mail to your tax centre.)

- When your documents are successfully submitted, you will receive a confirmation number and a reference number. Take note of these numbers and keep them in a safe place for future reference. A good way to save these is to add an annotation to the documents in DoxCycle. To learn how to do this, see the Annotations help topic. Or, you can print the confirmation page to PDF and import it into the DoxCycle file.

Should you have additional documents to include that relate to the first submission, you can include them at any time using the case/reference number. Use DoxCycle annotations to keep track of the version of the documents that you sent to the CRA.

For more information on submitting documents online, visit the CRA web page.

After submitting documents

If a review has been completed, you may submit additional documents. You will need to use the reference number from the initial letter received from the Processing Review Program. Please pay special attention to the instructions on the confirmation page as a new reference number may be provided.