|

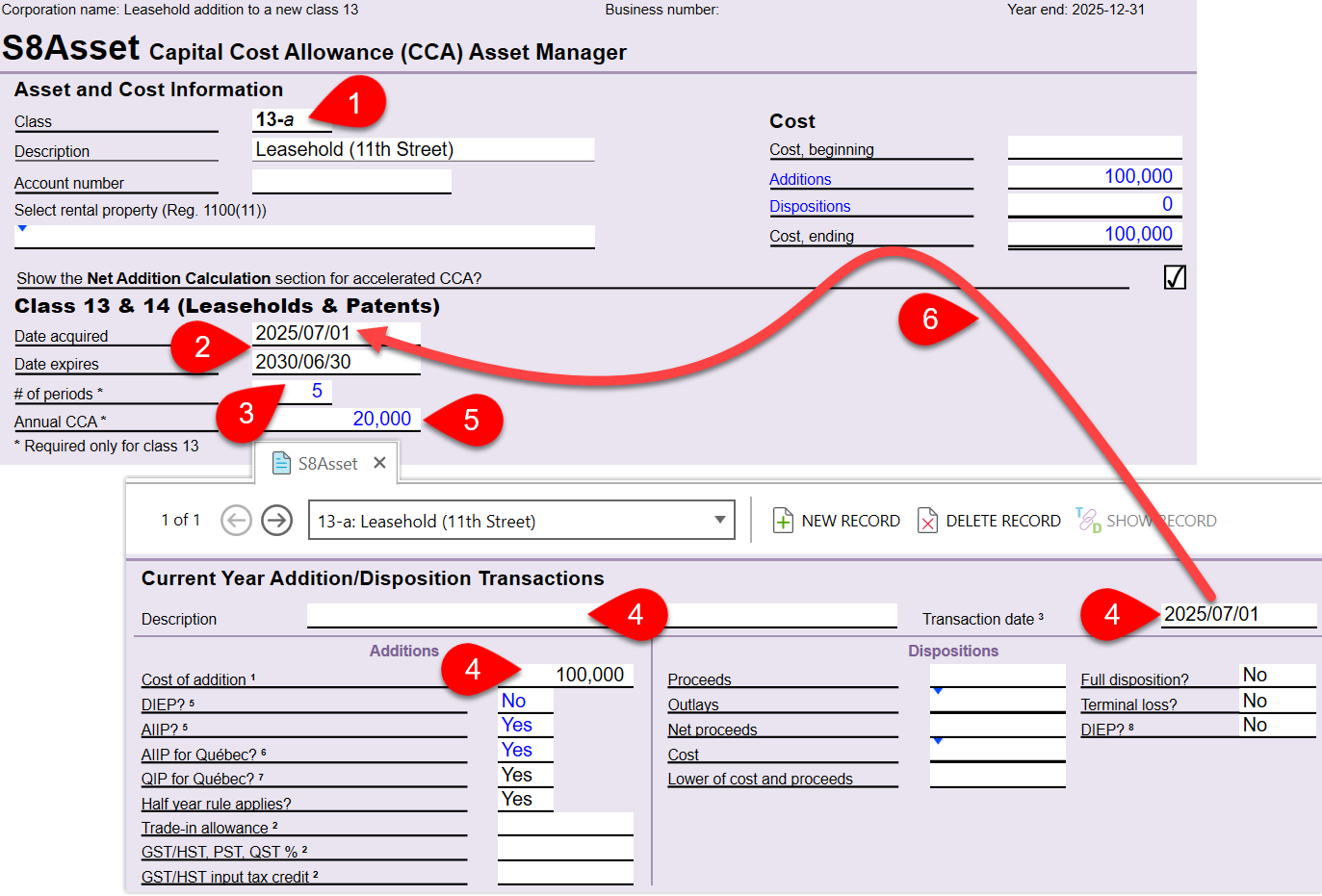

Tax year: January 1, 2025, to December 31, 2025

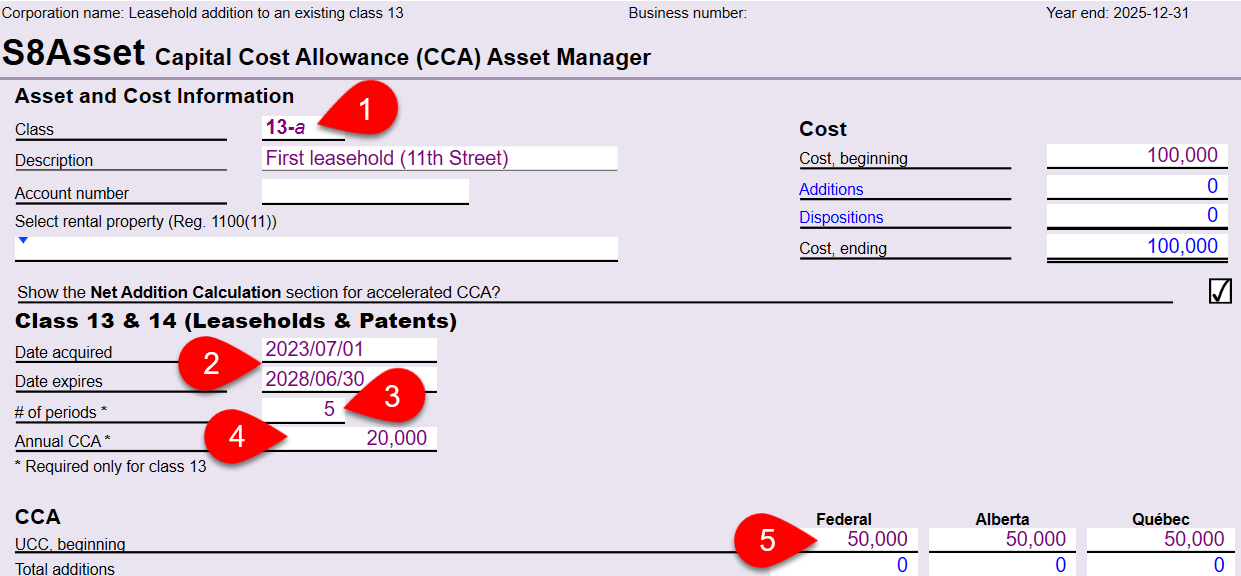

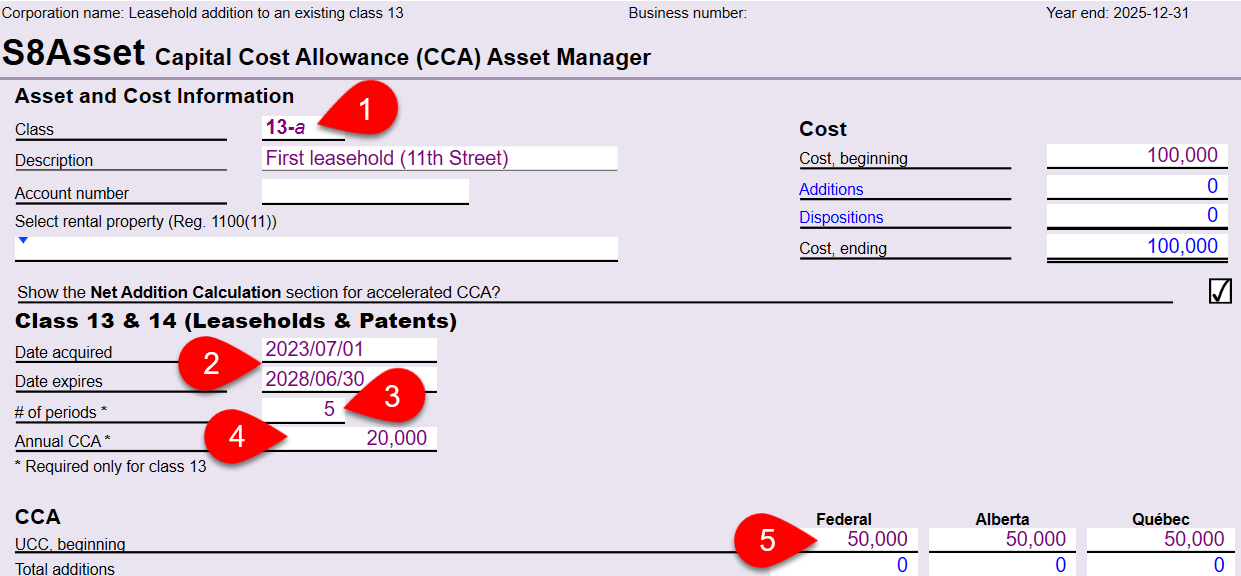

Lease term: July 1, 2023, to June 30, 2028 (5-year term)

Cost of leasehold interest paid in 2023: $100,000

Annual CCA: $20,000 ($100,000/5-year lease term)

Opening UCC = $50,000

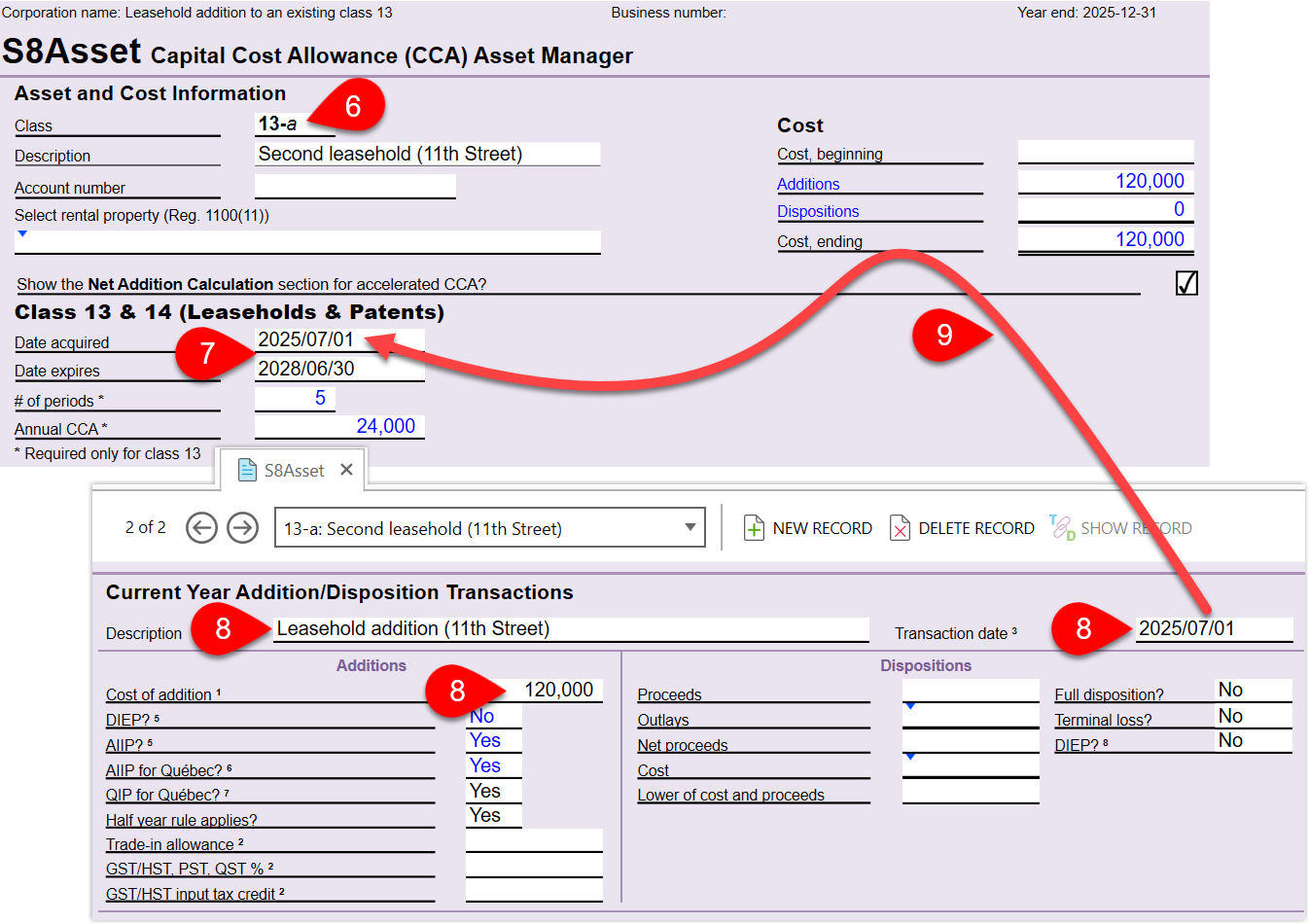

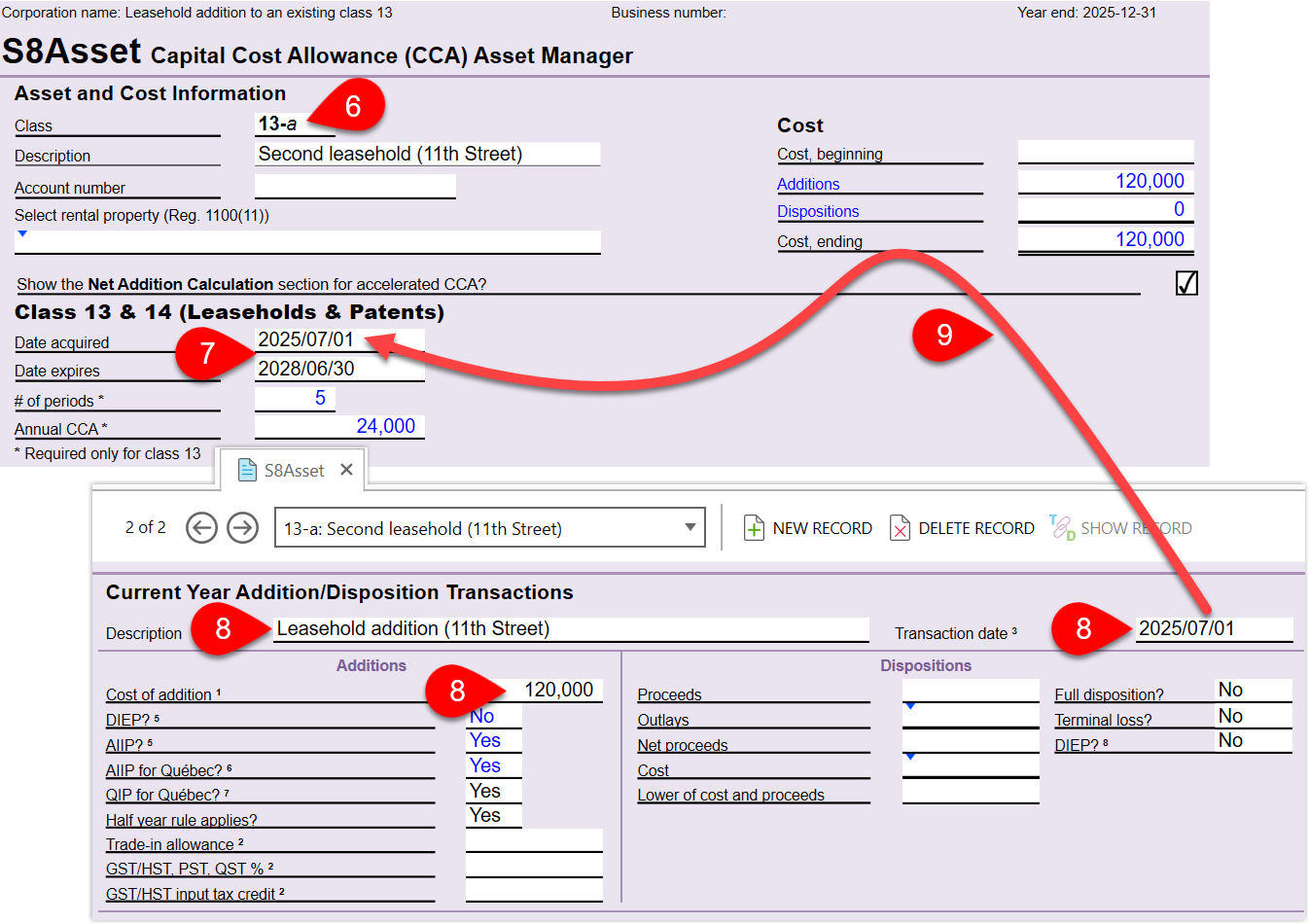

On July 1, 2025, additional leasehold interest was paid in respect of the existing lease agreement.

Cost of additional leasehold interest = $120,000

In this case, you must create two instances of class 13-a (one for the existing leasehold improvement and another for the addition of a new leasehold improvement to the same property).

If you carried forward a TaxCycle file, you can skip steps 1 through 5.

- Create a class 13-a on the S8Asset and enter information with respect to the existing leasehold interest.

- Enter the date the lease starts (Date acquired) and the date it ends (Date expires).

- Enter the number of 12-month periods (the minimum leasehold interest amortization period cannot be less than five years and the maximum period cannot be greater than five years).

- Enter the Annual CCA ($100,000/5 years).

- Enter the opening UCC.

- Create another instance of class 13-a to record a leasehold improvement addition to the same property.

- Enter the leasehold interest term. The Date acquired must be the date the additional leasehold interest was paid for. The Date expires must be the end date of the lease term of the property. TaxCycle automatically calculates the number of 12-month periods.

- Enter the description, the transaction date and the cost of addition (leasehold amount).

- The transaction date must match the date acquired so that the annual CCA can be calculated.

|